Not known Incorrect Statements About Hard Money Georgia

Table of ContentsSome Known Factual Statements About Hard Money Georgia Rumored Buzz on Hard Money GeorgiaThe 7-Minute Rule for Hard Money GeorgiaThe Ultimate Guide To Hard Money Georgia

Given that tough money lendings are collateral based, also recognized as asset-based lendings, they need minimal documents as well as allow capitalists to shut in an issue of days. These fundings come with even more danger to the lending institution, as well as as a result require greater down settlements as well as have higher rate of interest rates than a typical car loan.Numerous traditional financings may take one to two months to close, yet hard money fundings can be shut in a couple of days.

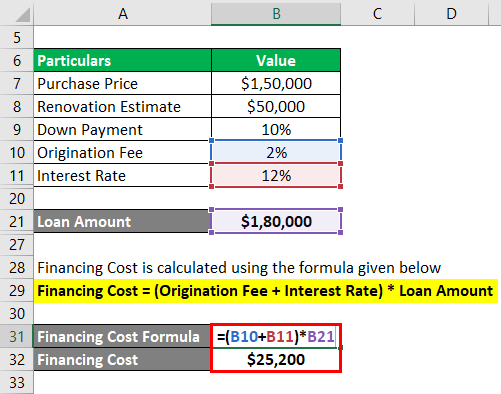

Traditional mortgages, in comparison, have 15 or 30-year payment terms on standard. Tough cash finances have high-interest prices. The majority of difficult money car loan interest rates are anywhere in between 9% to 15%, which is considerably greater than the rate of interest rate you can expect for a typical mortgage.

As soon as the term sheet is authorized, the financing will certainly be sent to processing. Throughout funding processing, the loan provider will request files and prepare the loan for last lending evaluation as well as timetable the closing.

The Hard Money Georgia Diaries

Basically, due to the fact that individuals or corporations offer hard money financings, they aren't subject to the exact same policies or constraints as banks as well as cooperative credit union. This implies you can obtain distinct, personally tailored difficult cash loans for your certain demands. That claimed, tough cash car loans have some disadvantages to remember before seeking them out.

You'll require some resources upfront to certify for a tough cash funding as well as the physical home to serve as collateral. In enhancement, tough money lendings generally have higher passion prices than conventional mortgages.

Usual departure techniques consist of: Refinancing Sale of the asset Payment from various other source There are several circumstances where it might be advantageous to make use of a hard cash car loan. For beginners, actual estate financiers that like to house turn that is, acquire a review home in requirement of a whole lot of work, do the job personally or with service providers to make it better, then reverse and offer it for a greater price than they purchased for might find tough money fundings to be excellent financing options.

Because of this, they do not require a lengthy term and also can avoid paying also much passion. If you acquire investment residential or commercial properties, such as rental residential properties, you may likewise discover hard money lendings to be good choices.

The Definitive Guide to Hard Money Georgia

Sometimes, you can additionally utilize a tough cash loan to buy vacant land. This is an excellent option for programmers that remain in the process of certifying for a building lending. Note that, even in the above circumstances, the potential downsides of hard cash fundings still apply. You need to make sure you can pay back a tough money car loan prior to taking it out.

Hard cash loans generally come with higher rate of interest and also shorter repayment timetables. Why select a difficult money loan over a traditional one? To answer that, we must first take into consideration the benefits as well as downsides of difficult cash fundings. Like every monetary tool, Go Here tough cash lendings come with benefits and also negative aspects.

The 6-Minute Rule for Hard Money Georgia

Furthermore, due to the fact that private individuals or non-institutional lenders use tough cash loans, they are not subject to the same regulations as conventional lenders, which make them extra dangerous for customers. Whether a difficult cash lending is ideal for you depends on your circumstance. Hard money lendings are great alternatives if you were refuted a traditional funding and also require non-traditional financing.

Get in touch with the expert home loan advisors at Right Start Home Mortgage. hard money georgia for even more info. Whether you intend to purchase or refinance your residence, we're here to help. Get going today! Request a totally free customized price quote.

The application procedure will generally entail an evaluation of the residential property's value as well as capacity. By doing this, if you can not manage your payments, the tough cash lender will merely relocate in advance with marketing the residential or commercial property to redeem its investment. Difficult money lenders typically bill greater interest rates than you would certainly carry click site a traditional loan, but they additionally money their loans more swiftly and also typically require much less documents.

Rather of having 15 to thirty years to pay back the car loan, you'll normally have just one to 5 years. Hard money financings function fairly in a different way than traditional fundings so it's vital to understand their terms as well as what transactions they can be utilized for. Hard cash loans are commonly planned for investment buildings.